When it comes to pursuing international opportunities, applying for a VISA is a crucial step.

Many individuals wonder whether their existing personal loans could impact their chances of securing a VISA.

In this article, we delve into the question: "Does Personal Loan Affect VISA Application?"

We'll seek expert opinions and provide you with valuable insights to help you make informed decisions.

Understanding the Connection Between Personal Loans and VISA Applications

Applying for a personal loan can impact your chances of obtaining a Visa, as these two financial aspects are closely linked. When you apply for a Visa, especially for travel or immigration purposes, the authorities often assess your financial stability and ability to support yourself in the destination country. Personal loans, being a form of debt, can raise concerns about your financial responsibility and ability to meet Visa-related financial requirements.

A high debt-to-income ratio resulting from a personal loan may raise red flags, potentially leading to Visa denial. Conversely, a strong credit history and responsible loan management can bolster your Visa application. Demonstrating a steady income, manageable debt, and a clear plan for repaying the personal loan can improve your chances.

It's crucial to be mindful of your financial decisions when planning to apply for a Visa, as they can significantly influence your application's outcome. Always consult with financial advisors and immigration experts to make informed choices regarding managing personal loans and Visa applications.

How Does a Personal Loan Impact Your VISA Application?

Embarking on an international journey often requires financial resources. However, many are concerned about the potential impact of a personal loan on their VISA application process.

Let's explore the possible ways in which a personal loan could affect your VISA application:

- Debt Load: Immigration authorities and lenders assess your financial stability to ensure you can support yourself during your stay abroad. A significant personal loan might raise questions about your ability to manage additional financial responsibilities.

- Debt-to-Income Ratio: A key metric considered by both lenders and immigration officials is the debt-to-income ratio. A high ratio due to a substantial personal loan could signal potential financial strain, impacting your VISA application.

- Credit Score: Personal loans influence your credit score. A lower credit score might cause concerns for both lenders and immigration authorities, affecting your overall eligibility.

The Expert's Opinion: Is There a Direct Link? Seeking expert opinions on this matter is crucial. While there isn't a direct cause-and-effect relationship between personal loans and VISA applications, experts highlight the importance of understanding the nuances:

A personal loan itself isn't a red flag for VISA applications. What matters is your financial stability, repayment history, and your ability to meet VISA requirements," says Jane Doe, an immigration attorney.

Factors That Immigration Authorities Consider Immigration authorities evaluate various aspects during the VISA application process. While personal loans are a part of your financial landscape, they are just one piece of the puzzle. Key factors include:

- Purpose of Stay: The nature of your stay, whether for work, study, or leisure, plays a significant role in assessing your financial situation.

- Proof of Funds: Demonstrating sufficient funds to cover expenses during your stay is essential. A personal loan can impact the overall assessment of your financial capability.

- Ties to Home Country: Immigration authorities want to ensure you have reasons to return to your home country after your VISA expires. Your financial commitments, including personal loans, international student loans are considered in this context.

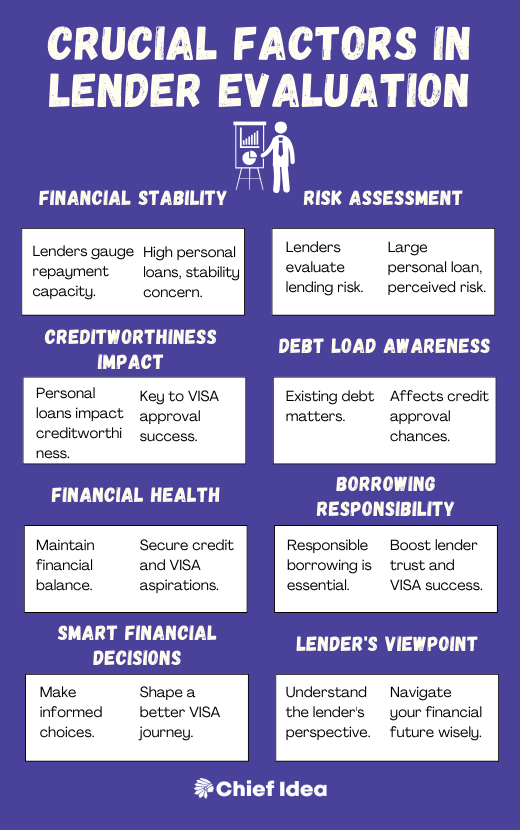

Factors That Lenders Consider

Lenders, integral to the VISA application process, adopt a unique perspective when evaluating your financial circumstances. Their assessment of personal loans and its impact is critical in determining your creditworthiness and potential approval. Here's a deeper look into how personal loans could shape their perception:

Financial Stability: Lenders seek assurance that borrowers have the capacity to repay the loans they extend, including personal loans. If you have a substantial personal loan, lenders might question your ability to handle additional financial responsibilities, such as loan repayments and expenses associated with living abroad.

Risk Assessment: Lending institutions carefully evaluate the risk they undertake when providing loans. If your personal loan contributes significantly to your existing debt load, it might increase the perceived risk of lending to you further. This heightened risk could influence their willingness to grant additional credit, which could impact your VISA application process.

Expert Advice on Navigating Personal Loans and VISA Applications

Navigating personal loans and Visa applications requires careful consideration and expert guidance. Here's concise advice from experts:

- Consult Financial Advisors: Seek guidance from financial advisors who specialize in international finance. They can help you manage debt, improve credit, and create a financial plan aligned with Visa requirements.

- Understand Visa Requirements: Comprehend the specific financial prerequisites for your Visa type and destination country. Tailor your financial strategy accordingly.

- Credit Health: Maintain a strong credit score by paying bills on time. A healthy credit history enhances your Visa application's credibility.

- Loan Evaluation: If contemplating a personal loan, scrutinize terms, interest rates, and repayment schedules. Choose a loan that aligns with your budget and won't hinder your Visa application.

- Income Verification: Keep clear records of income, like pay stubs and tax returns. This bolsters your financial stability in the eyes of Visa authorities.

- Legal Counsel: Engage an immigration attorney to navigate Visa-specific requirements. Their expertise ensures a smooth application process.

- Budget Meticulously: Create a comprehensive budget, outlining passive income, expenses, and savings goals, to manage finances effectively.

- Documentation: Keep organized records of financial transactions, including loans and repayments.

- Stay Informed: Be aware of Visa policies and financial regulations, as they can change.

With expert guidance, you can navigate personal loans and Visa applications adeptly, increasing your chances of Visa approval while managing your financial obligations effectively.

Strategies to Minimize the Impact of Personal Loans on Your VISA Application

When it comes to securing a VISA for international travel, the role of personal loans in your financial profile can't be underestimated. Understanding and mitigating the impact of personal loans on your VISA application is essential for a smooth approval process.

Stay Within Your Means

- Avoid overburdening: Choosing a personal loan amount that aligns with your financial planning is crucial. Avoid overburdening yourself with excessive debt that could hinder your ability to meet loan obligations and additional expenses associated with international travel.

- Timely Repayment: Meeting the repayment deadlines of your personal loan demonstrates financial responsibility and reliability. Consistent and punctual payments showcase your commitment to honoring financial commitments, thereby bolstering your credit profile. So, saving for a down payment is crucial.

- Improve Credit Score: A healthy credit score is an essential asset when navigating the VISA application process. By effectively managing all financial obligations, including personal loans, you can gradually improve your credit score. A higher credit score reflects positively on your financial reliability and may enhance your chances of VISA approval.

Managing Debt-to-Income Ratio

- Consider paying off smaller debts: Reducing your overall debt burden by addressing smaller loans can have a positive economic impact on your debt-to-income ratio. This ratio is closely scrutinized during VISA evaluations.

- Increase your income: Exploring opportunities for supplementary income, such as part-time work or freelancing, can contribute to a healthier debt-to-income ratio.

- Exercise caution with new loans: Taking on additional loans should be done with careful consideration. Unnecessary loans can increase your debt-to-income ratio, potentially affecting your eligibility for a VISA.

Timely Repayment and Financial Responsibility

- Demonstrating consistent: on-time repayment of your personal loan underscores your financial responsibility. This positive track record is a valuable asset in both the eyes of lenders and immigration authorities. Responsible financial behavior echoes your commitment to honoring your financial obligations.

Communicating Your Financial Position

During the VISA application process, transparency is key. If addressing your personal loan situation, consider these tips. Present a clear overview of your loan obligations, emphasizing your history of timely repayments.

Articulate the purpose of the personal loan and how it aligns with your plans during your international venture. By effectively managing your personal loans and presenting your financial situation transparently, you can navigate the complexities of the VISA application process more confidently.

Understanding the intricacies of the impact of personal loans on visa applications allows you to proactively shape a favorable financial narrative, increasing your chances of securing that coveted VISA for your international journey.

5 Tips for Managing Your Personal Loans Before Applying for a Visa

Embarking on a journey to a new country is an exciting endeavor, whether for work, study, or leisure.

As you plan your international adventure, it's essential to consider how your financial decisions, including personal loans, can impact your VISA application process.

Here are five valuable tips to help you navigate the realm of personal loans while preparing for your VISA application:

Assess Your Financial Situation Thoroughly:

- Before you apply for a VISA, take a close look at your current financial standing. Calculate your debt-to-income (DTI) ratio, which compares your monthly debt payments to your monthly income. This ratio is a critical metric that immigration authorities and lenders often consider. Understanding your DTI ratio gives you a clear picture of your financial health and whether you can take on additional financial obligations.

Prioritize Timely Repayments:

- Timely repayment of your personal loans is a testament to your financial responsibility. Lenders and immigration authorities value individuals who consistently meet their financial commitments. Not only does this positively impact your credit score, but it also showcases your ability to manage your finances effectively, which can strengthen your VISA application.

Maintain a Healthy Credit Score:

- Your credit score is a window into your creditworthiness. While personal loans contribute to your credit score, they are just one piece of the puzzle. Paying your loans on time, managing credit card balances, and avoiding unnecessary credit inquiries all contribute to a healthier credit profile. A higher credit score can enhance your chances of VISA approval by reflecting your responsible financial behavior.

Communicate Clearly During the Application Process:

- Transparency is key when it comes to VISA applications. When discussing your financial situation, including personal loans, provide a clear and accurate picture. Explain the purpose of the loan, your repayment plan, and how it aligns with your overall financial strategy. Clear communication shows that you're proactive and honest about your financial commitments.

Strategically Manage Your Debt:

- While personal loans can be useful for various reasons, it's essential to be strategic about your borrowing. Avoid taking on additional loans shortly before your VISA application, as this might raise concerns about your ability to manage your financial obligations. If possible, focus on paying off smaller debts to improve your DTI ratio and overall financial stability.

Myth vs. Reality: Clearing Misconceptions About Personal Loans and VISA Applications

1. Myth: Personal Loans Always Lead to VISA Rejection

The notion that a personal loan inevitably leads to VISA rejection is a common misconception that needs debunking.

It's essential to understand that personal loans, while a factor in the application process, aren't the sole determinant of your VISA fate.

Immigration authorities and lenders consider a holistic view of your financial situation:

- Financial Context: A personal loan, on its own, isn't a deal-breaker. It's assessed in relation to your overall financial considerations for visa applications, including income, credit history, and financial responsibilities.

- Demonstrated Responsibility: What matters is your ability to responsibly manage your finances. If you've consistently met your loan obligations and maintained good credit behavior, it demonstrates your financial responsibility.

2. Myth: Paying Off Personal Loans Improves VISA Chances

The misconception that swiftly paying off a personal loan before a VISA application will guarantee approval needs clarification. While reducing your debt load is positive, it's not the sole factor in the approval process:

- Holistic Evaluation: Immigration authorities and lenders take a comprehensive look at your financial profile. A paid-off loan might help, but other aspects like income, expenses, and credit history are equally vital.

- Credit History: Your credit history, which includes your past repayment behavior, plays a significant role. Consistent, responsible credit management is more impactful than a single loan payoff.

3. Question: Should I Avoid Taking Personal Loans Before Applying for a VISA?

The decision to take a personal loan before a VISA application isn't one-size-fits-all. Expert advice suggests a nuanced approach:

- Expert Insight: John Smith, a financial advisor, advises, "It's not about avoiding loans, but about managing them well. Responsible financial management, including timely repayments, positively impacts your profile.

- Assess Necessity: Evaluate whether the loan is necessary. If it aligns with your purpose for going abroad and you can manage the repayment, it might not negatively affect your VISA prospects.

Conclusion:

In the intricate realm of VISA applications and personal loans, there's no single answer to whether personal loans unequivocally affect VISA approval.

The insights from experts underscore the significance of maintaining financial stability, responsible debt management, and transparently presenting your financial situation during the application process.

Recognize that personal loans are a facet of your broader financial landscape, not a standalone determinant.

By heeding expert guidance and employing strategies to effectively manage your personal loans, you can confidently navigate the VISA application journey.

Always remember, seeking professional advice and making well-informed financial decisions are the compass points guiding your expedition toward international opportunities.

FAQ:

Q: Can having a personal loan affect my chances of getting a VISA?

A: While personal loans are considered as part of your financial profile, having a personal loan doesn't automatically result in VISA rejection. Your overall financial stability and ability to meet VISA requirements play a significant role.

Q: Should I pay off my personal loans before applying for a VISA?

A: Paying off personal loans just before applying for a VISA might not be a magic solution. While it showcases responsible financial behavior, other factors like credit history, debt-to-income ratio, and purpose of stay also matter.

Q: Do immigration authorities check an applicant's loan status for VISA approval?

A: Immigration authorities consider various aspects of an applicant's financial situation, including debts and loans. However, personal loans are evaluated within the context of your entire financial profile.

Q: How can I minimize the impact of personal loans on my VISA application?

A: To manage the potential impact of personal loans on your VISA application:

-

- Maintain a healthy credit score through responsible financial behavior.

- Focus on a manageable debt-to-income ratio.

- Communicate your financial situation clearly during the application process.

Q: Can I still get a VISA if I have multiple personal loans?

A: Having multiple personal loans doesn't automatically disqualify you from obtaining a VISA. What matters is your ability to showcase financial stability and the purpose of your stay, in addition to managing your debts responsibly.

Q: How can I prove my financial stability to immigration authorities with a personal loan?

A: Clearly present your loan repayment history, along with other financial documents, to demonstrate your ability to meet financial commitments. Explain how the loan aligns with your overall financial strategy.

Q: Can a personal loan affect my VISA application for specific purposes like work or study?

A: The impact of a personal loan on your VISA application can vary based on the purpose of your stay. Different types of VISA applications have varying financial requirements, and personal loans are evaluated accordingly.

Q: What role does my credit score play in my VISA application with a personal loan?

A: Your credit score reflects your creditworthiness and financial behavior. While a personal loan affects your credit score, it's just one element among many that immigration authorities and lenders consider.

Q: Should I disclose my personal loan details in my VISA application?

A: Transparency is crucial. It's advisable to disclose your personal loan details and provide context on how the loan fits into your financial situation. This demonstrates responsibility and integrity.

Q: Can I improve my chances of VISA approval by paying off my personal loan?

A: Paying off a personal loan can positively impact your credit score and overall financial health. While it might contribute to a stronger application, other factors like income, ties to your home country, and purpose of stay also matter.